Acquisition project | Newton Classroom

Elevator Pitch

Newton is transforming K12 educational management by integrating cutting-edge technology and innovative, consumerised product design. Schools face the challenge of managing complex academic, operational, and administrative tasks without the necessary data to drive success.

While 95% of Indian educators consider themselves tech-savvy, less than 10% use technology for daily school activities. Newton fills this gap with a unified, intuitive platform that enhances learning outcomes, streamlines operations, automates tedious tasks and enables data-driven decisions. Newton is for all everyone - Admins, Educators, Staff, Students and Parents with dedicated mobile and web interfaces.

Newton is the all-in-one system our partner schools rely on to manage everything—from admissions and finance to academics, staff management, and parent communication. With the highest user adoption rates in the market, Newton outperforms competitors by >400%. We’re not just redefining ERP; we’re shaping the future of tech-assisted education!

Understanding the Product

Q. What is the fundamental need or want that the product is solving for?

K12- Schools need a comprehensive and reliable management system to smoothly conduct and manage their academic, administrative and operational activities. Like most other business organisations schools also need to handle multiple functions from academics to fee collections to enrolment to employee management, parent communication and more.

Currently, most Schools unfortunately have to rely on legacy, complex service solutions this need. Most solutions in the market are 10+ years old and cluttered with poor integration abilities

Q. What are the basic features and functionalities that the product provides?

Since Newton is a unified system its expected to deliver a replacement for to the incumbent ERPs which are :

- SIS, Timetables, Diary, Student Attendance, Grading management and other such academic modules

- Finance, Admissions, HRMS, communication, noticeboard and other such administrative modules

- Transport, IT, Inventory, facilities and other such operational modules

- Web and Mobile logins with multiple stake holder logins : Admin, Owner, Teacher, Staff, Students and Parents

- Whitelabelled [Paid]

Q. What other ways are users using to solve the same problem? If it is a new category, how else were people solving the problem?

Users currently use current ERP offerings in the market which are outdated, slow and complex. For business critical functions they rely on the “best of the breed” point solutions. For example using whatsapp business via WATI to communicate with parents

Pain points :

- Does not integrate with ERP hence information is almost always out of date and in Excel sheets

- Using multiple point solutions will drive up the costs

- Any data update must be taken up at multiple places

- New Staff must be trained in multiple tools

- No oversight for management and decision makers

The current spread of Unified ERP vs Point solutions in schools is 35% - 65% and on an average schools use up to 15 applications to get through all their functions (*study from 2023)

The current

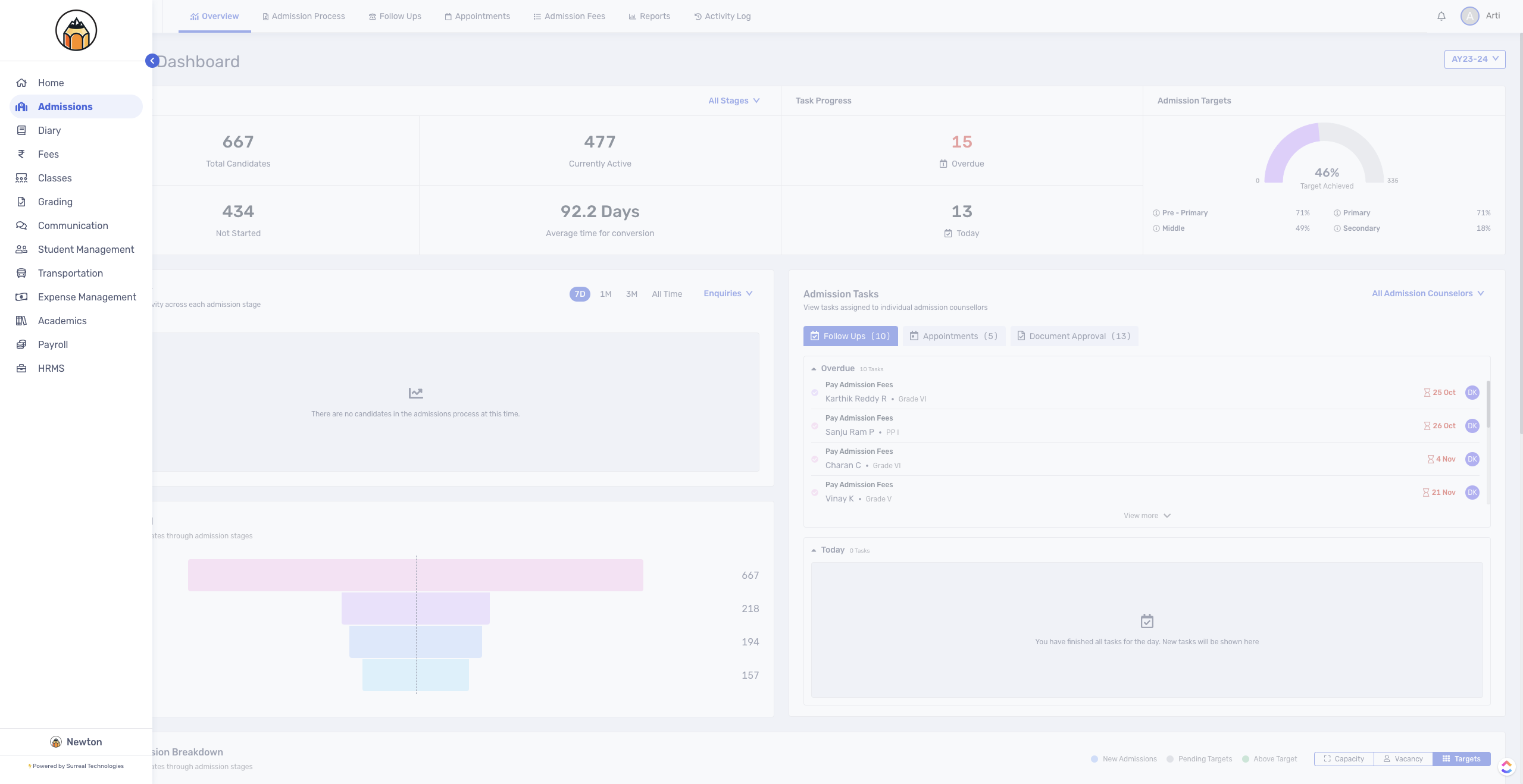

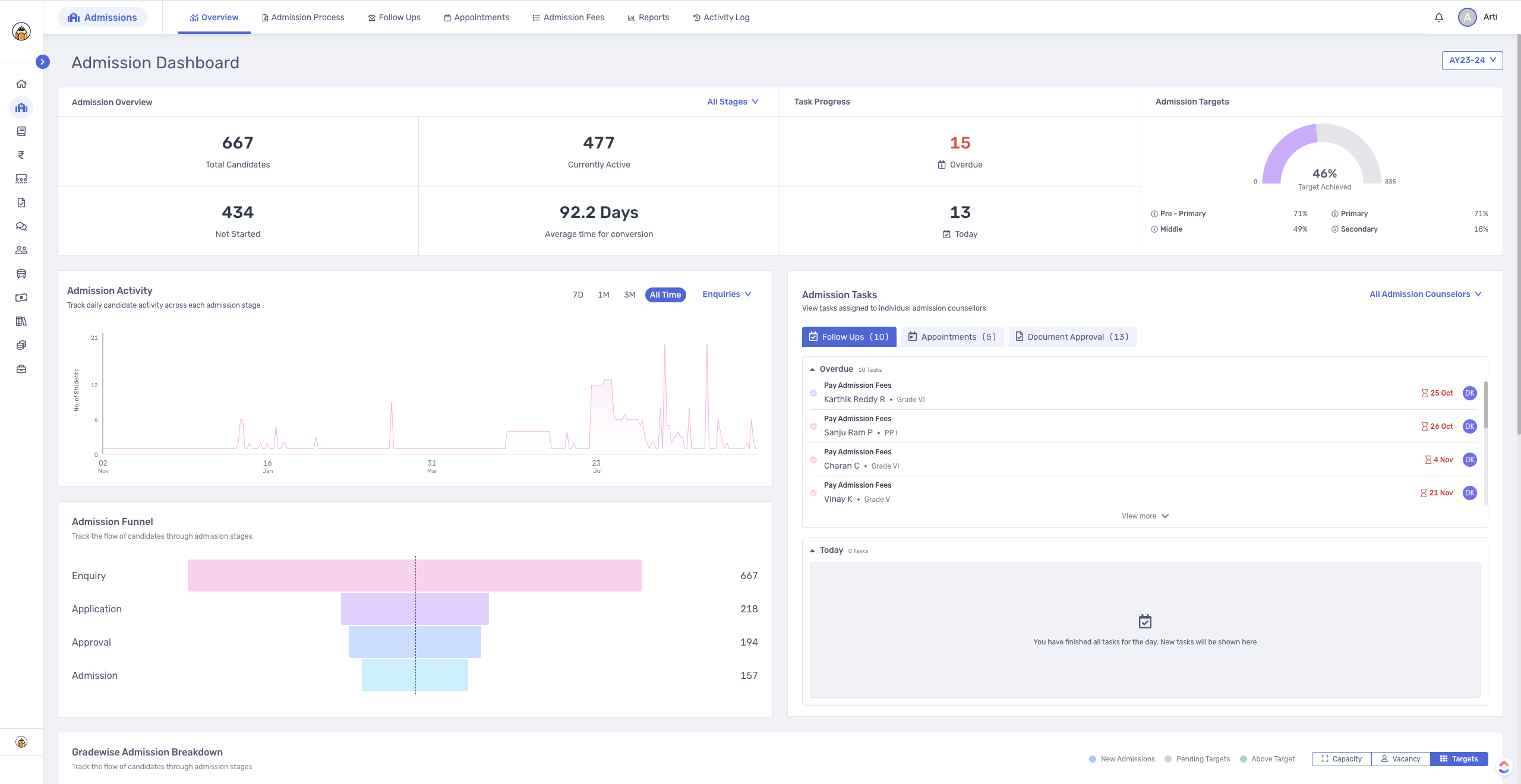

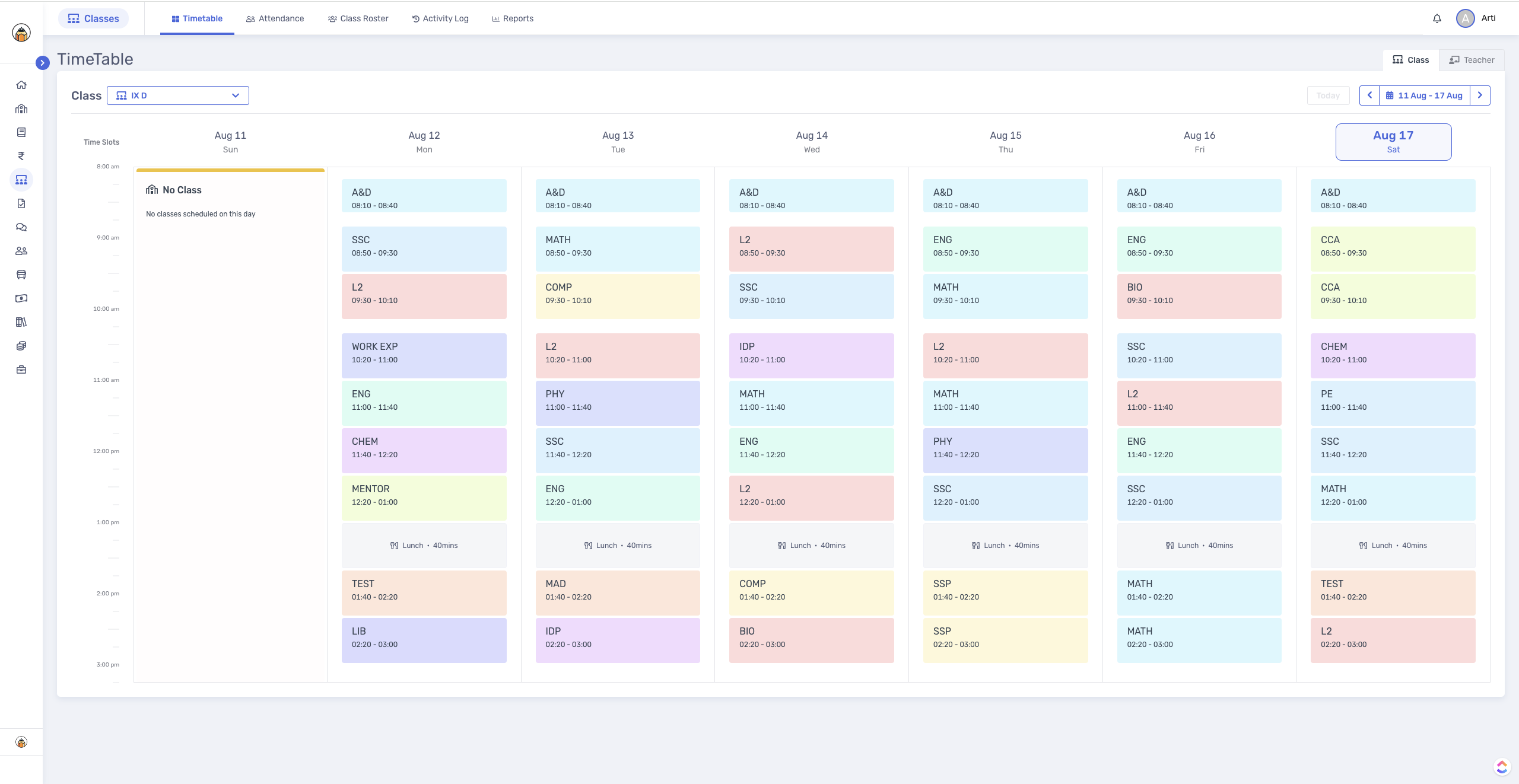

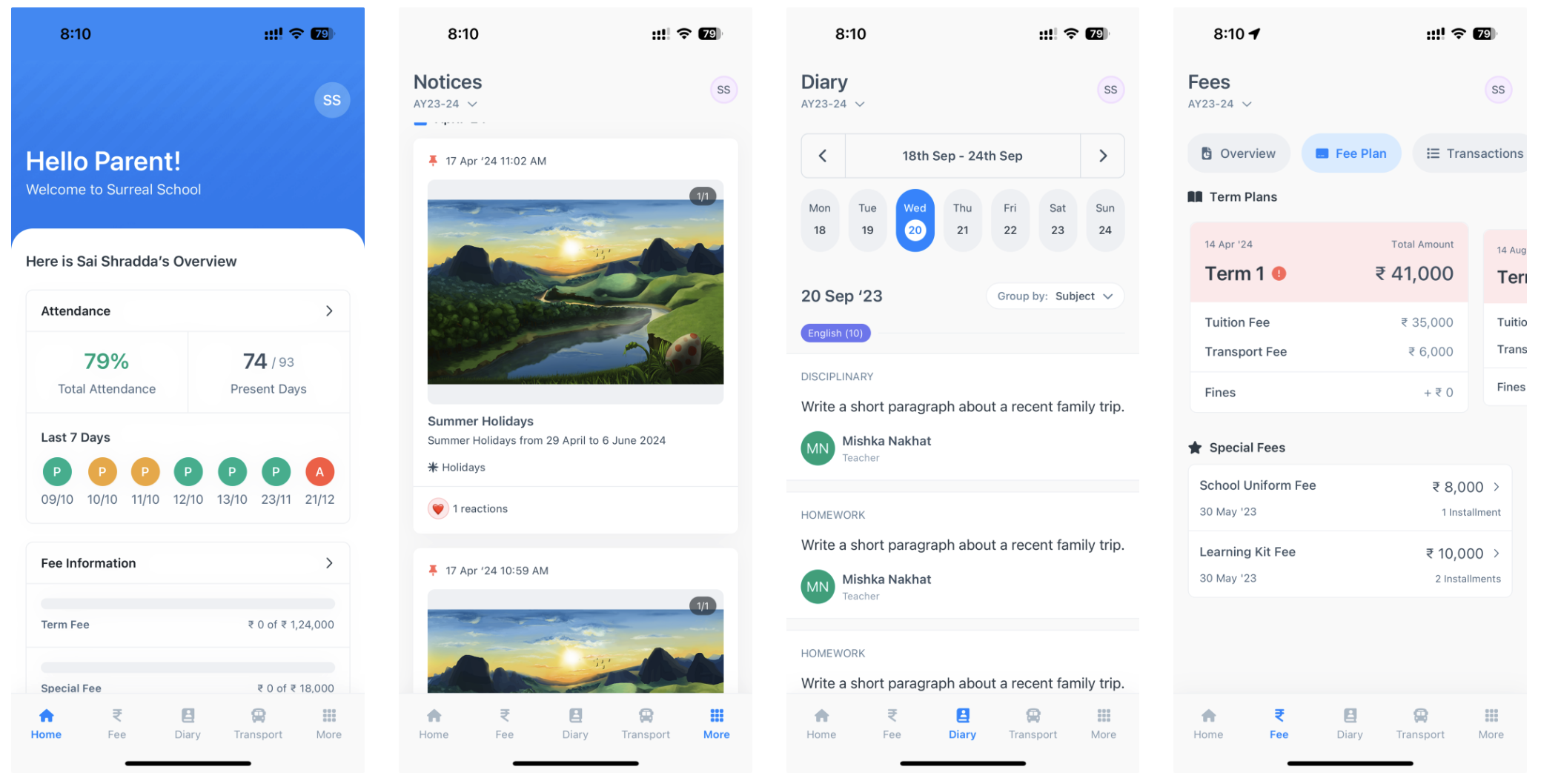

A. Newton sample screens :

- All Modules opened on the left menu

- Typical Admin dashboard for a module (Admissions)

- Teacher Timetable View

4. HR Admin Staff Attendance view

5. Parent Login - Mobile App

B. Kotler and Keller's Five Product Levels model

[Applied to Newton]

1. Core Benefit:

The core benefit of Newton is its ability to manage all operational, administrative and academic functions in one unified, easy-to-use solution. This will enable schools to automate non-academic task overheads while maximising time for teaching and improving learning outcomes + ability to make data-driven decision

2. Generic Product:

The generic product of Newton includes all the essential features required for it to function as a replacement ERP for our prospective customer base. These features include:

- SIS, Timetables, Diary, Student Attendance, Grading Management, Report cards and other such Academic modules

- Finance, Admissions, HRMS, Parent Communication, Noticeboard, Concern Management and other such Administrative modules

- Transport, IT, Inventory, Facilities and other such Operational modules

- Web and Mobile logins with multiple stakeholder logins: Admin, Owner, Teacher, Staff, Students and Parents

- Whitelabelled [Paid]

3. Expected Product:

*Newton is currently in this stage of getting ready for early scaling

- Easy to learn and use interfaces with strong training programs

- Strong pipeline with constant innovation and feature releases

- Reliable performance and minimal downtime

- Process workflows based on School processes

- Custom feature development requests (as add-on services)

* Based on interviews with 100+ school leaders, and educators from 2023-2024

4. Augmented Product:

*By the time Newton approaches the Augmentation stage, we would have cracked a high adoption rate in the marketing leading to - High data accuracies.

- Advanced analytics and reporting tools that provide data-driven insights for better decision-making.

- Seamless integration with other tools and platforms, such as Leadsquared, ASCII, Google Classroom, Zoom etc.

- Exceptional after-sales support, including personalized training sessions and ongoing technical assistance.

- String Parental mobile app features that keep parents informed and involved in their child’s educational journey.

5. Potential Product:

*Once Newton has realised its maximum adoption curve, on the back of the structured data we can start offering Schools powerful add-on features which will help them have a headstart in the market against their competitors in the race of Tech-enabled schooling

- AI-Powered Predictive Analytics

- Student and Teacher Well-being Monitoring

- Gamified Learning and Management

- Blockchain for Secure Record-Keeping

- Personalized Learning Paths Using AI

- Enhanced Parent Engagement Tools

- Data Privacy and Security Enhancements

- Student Portfolio and Career Pathway Planning

- Automated Compliance and Reporting

Understanding Core Value Proposition

While Newton helps K12 Schools and their educators digitise and manage multiple business and academic functions, it does so much more…. With high adoption rates across all users, Newton unlocks possibility for high accuracy in data that is now structured and reliable. Schools can start relying on data driven decisions for possibly the first time at this scale. As High adoption is a strong metric for success we offer strong auxiliary services that help constantly improve adoption : strong training, best after-sales support and constant usage monitoring in partnership with the School

While Newton helps K12 Schools and their educators digitise and manage multiple academic and business functions, it does much more than that. What Newton enables for your School is the true power of Deep-Tech : Data Driven decision making.

Despite most schools making between $250k - $10Mn dollars annually (in school fee collections), they do not have access to any tools that can enable them measure and process data and this is Newton's true value proposition. With Newton constantly putting efforts into building the best user-adoption rates in the market due to teacher & process-centric workflows - Schools unlock this new super power.

| Client 1 - Bangalore | Client 2 - Vizag | Client 3 - Hyderabad | Client 4 - Bangalore |

|---|---|---|---|---|

Why choose us over competition | Fast response, reliable, good features and Good support | Patient demos with multiple people, good product, passionate team | Best support, always available | Good App, better than old app |

Why do you keep doing business with us? | Good Support, always ready to help | Really good onboarding and support | Very responsive team | Fast App, good team |

What 3 words would you use to describe our company? | Honest, Good communication, Talented | Good People, Good support, Affordable | Innovative, Quick, Good price | Good communication, good support, good product |

If you were referring a friend to our business, what would you tell them about us? | Close your eyes and take it and be patient | Work with their team and for sure you will transform | No nonsense, good support | Better than all other sofwares |

👆Interview responses with KDMs from 4 Current B2B clents

- Newton offers High adoption -> High Data accuracy for decision making

- To support high adoption Newton offers strong training after-sales support

- Newton also monitors usage patterns to ensure a School has high adoption rates

- Core value proposition for a School is to leverage the power of data to transform their operational and teaching outcomes.

Understanding the Users

From my personal experience of selling for this brand over the last 3 years here are the various personas for Newton :

1. Decision Maker:

- School Owner / School Board : They are responsible to listening to the Influencer and approve large decisions and are priimairy focussed on the School's financial health, strategic direction, growth plan and long term benefits of this system

2. Influencer:

- School Principal/Administrator: The principal or school administrator is a significant influencer in the decision-making process. They are typically the ones who evaluate Newton's potential to improve school operations, enhance academic outcomes, and ease administrative burdens. They may also provide recommendations to the decision-makers based on their assessment.

- IT Manager/Coordinator: The IT manager or coordinator can also be an influencer, especially in larger schools. They assess the technical feasibility, compatibility with existing systems, and the level of IT support required for Newton's implementation and maintenance.

3. Blocker:

- Finance Manager/Controller: The finance manager or controller might act as a blocker if they perceive Newton as too expensive or not offering a clear return on investment. They are concerned with budget constraints, cost-benefit analysis, and ensuring that the financial implications of Newton align with the school's financial strategy.

- Teachers: In some cases, teachers can act as blockers if they are resistant to change, particularly if they perceive the new system as complex or time-consuming. Their acceptance is crucial for the system's success, and reluctance from this group can slow down or even halt the implementation process.

4. End User:

- School Principal/Administrator: They use Newton to manage daily school operations, monitor performance, and streamline administrative processes.

- Teachers: Teachers are end users who interact with Newton for tasks such as attendance, grading, lesson planning, and communication with parents.

- Students: Students interact with Newton through a portal that provides access to assignments, grades, noticeboard, diary and schedules.

- Parents: Parents use Newton to monitor their child's progress, communicate with teachers, and stay informed about school activities.

- Support Staff: Administrative and support staff use Newton for various tasks related to finance, HR, transportation, and facility management.

B2B Table:

Criteria | ICP1 | ICP2 |

|---|---|---|

School Name | School A | School B |

School Board | CBSE | IB |

Leadership | 2nd Gen educator, female, 31 yrs, Schools started by Father | 1st Gen Educator, Male, 48 yrs, Ex Businessman |

Location | Hyderabad | Bangalore |

School Type | Group Schools | Standalone |

Student Count | 1650 (1 branch) | 770 |

Fee Structure | 80,000 - 1,00,000 p.a. | 1,88,000 p.a. onwards |

Income Type | Medium - High Income | High Income |

Parent Household Income | 8 - 20 LPA | 15 - 40 Lpa |

Net Income | ~ 15CR | ~ 16.5 CR |

Decision Maker | Group Head, IT Director | Owner |

Decision Blocker | Principal, IT Heads | Principal, IT Heads |

Frequency of use case | Daily, for all functions | Daily, for all functions |

Growth Mode | Established, need to maintain strength | High Growth |

Business Focus | Brand Value, Good Academics | Brand Value, Happy Parents |

Tech Utilisation | Medium - High | Very High |

Staff Type | Experienced | Experienced, High specialisation |

Parent Expectations | Medium - High | High |

Education Focus | STEM | STEM, ARTS |

Decision Making | Centralised | Decentralised |

Parent Involvement | Low | Medium |

Data Security Importance | Medium | Very High |

Competitive Nature | High | High |

Satisfaction with current solution | Low - Neutral: It works for a few use cases | Very Low |

Appetite to pay | Medium | High |

Criteria | Group Schools | High Income Standalone |

|---|---|---|

Adoption Curve | Medium | High |

Appetite to Pay | Medium | High |

Frequency of Use Case | High | Very High |

Distribution Potential | High | Medium |

TAM (India) | 50K+ Schools | 10K+ Schools |

Understand Market

Factors | My Classboard | Teachmint | Competitor 3 | Competitor 4 |

|---|---|---|---|---|

What is the core problem being solved by them? | Same as Newton | Same as Newton + LMS | ||

What are the products/features/services being offered? | Same as Newton | Same as Newton + LMS | ||

Who are the users? | Low- Medium income schools | Low-income schools | ||

GTM Strategy | Low cost, Hard sales, longer sales contracts | Low-cost, discounted intro pricing, small player acquisition for scaling | ||

What channels do they use? | Outbound Physical sales, Inside sales, Educational events | Outbound Physical sales, digital ads, celebrity endorsements, Inside sales, Educational events | ||

What pricing model do they operate on? | Per student per month | Per student per month | ||

How have they raised funding? | Self - Funded | VC Funding | ||

Brand Positioning | | |||

UX Evaluation | Very Poor | Medium - Clean interfaces but not very flexible to a school process | ||

What is your product’s Right to Win? | Strong Workflows with great teacher-centric UX with industry-best support | Strong support with a stable product pipeline. Easy onboarding and self-serviceability | ||

What can you learn from them? | Strong customer retention via constant engagement | Scale with Acquisition to get to 1000+ schools in 2 years |

(then try to understand the market at a macro level and evaluate the trends and tailwinds/headwinds.)

Tailwinds

- Rising competition for legacy brands from new-age schools

- Post Covid changes in teaching - learning loop

- The rising availability of high-quality, tech-enabled learning options

- Rise of AI and Schools interested in their application for teaching

- Parents Expecting More from Schools

Headwinds

- Resistance to Change from top to down

- Increasing sales cycles (due to many options)

- Implementation challenges (due to poor data backups)

- Non forward-thinking leadership

- Low-cost alternatives

Now it’s time for some math, calculate the size of your market.

TAM = Total no. of potential customers x Average Revenue Per Customer (ARPU)

SAM = TAM x Target Market Segment (percentage of the total market)

SOM = SAM x Market Penetration/Share

* For the sake of simplicity sticking to the Indian market for now and taking a top-down approach

TAM (Indian)

No of Private Schools in India: 3.40 lac

No fo Public + Aided Schools in India: 11.8 lac

Since our company is focused on Medium to High-Income Schools with a strong revenue ARR we will only calculate TAM for private schools

No of Students going to Private schools in India: 9.8 Cr

Average ERP revenue per user per student: 500

Average Addon revenue per school: 1.5 lacs

Average LMS revenue per student: 1500

Total ERP revenue: 4,900 Cr

Total Addon revenue: 5,100 Cr

Total LMS revenue: 14,700 Cr

Total Addressable Market = ERP + Addon = 24,700 Cr

TAM = $2.8 Billion

SAM (Indian)

ICP :

- Medium to High Income

- Group Schools or Premium Standalone

- Tier I and Tier II cities

- ICSE, CBSE, IB and Cambridge Board

- Medium - High-income households

- Annual Fees of 75K and above

ICP Private Schools in India: 60,000 Schools

Average Students per school: 700

Total student count: 4.20 Cr

Average ERP revenue per user per student: 500

Average Addon revenue per school: 1.5 lacs

Total ERP revenue: 2,100 Cr

Total Addon revenue: 900 Cr

Serviceable Addressable Market = ERP + Addon = 3,000 Cr

SAM = $360 Million

SOM (Indian)

Due to strong tailwinds from the post-Covid tech adoption and brimming AI revolution in education, we expect that the market will consolidate to one / two large players eventually. But before that through our top of the pyramid sales focussed approach we can expect to capture up to 25-30% of the market in the next 3-4 years.

- High focus on self-serviceability of the product

- Robust scalable deployment teams

- Strong Tech advantage

- Market highest adoption rates

- Generative AI experiments

- Strong customer feedback

@ 25% Market share we can expect

School Count: 12,000 Schools

Average Students per school: 750

Total student count: 90 Lac

Average ERP revenue per user per student: 500

Average Addon revenue per school: 1.5 lacs

Total ERP revenue: 450 Cr

Total Addon revenue: 180 Cr

Servicable Obtainable Market = ERP + Addon = 630 Cr

SOM (Indian) = $75 Million

Given Newton's market positioning and existing customer base, we can say it is in the early scaling stage. Newton has achieved PMF and is focusing on expanding it's customer base and growing the market reach.

Acquisition channels:

Current Acquisition Channels :

- Inside Sales - Cold calling and setting up meetings at schools

- Educational events - Sponsorship in exchange for stall space and presentation slots > conversions from events

- Word of mouth and soft referral requests to current “happy” customers

- The right time to get this referral is when we deliver a custom module they requested on time

- Cold-visits on School locations

Redefined Acquisition channels for redefined GTM :

- Partnerships with Education companies who deliver content / coursework

- Ex : Dreamtime learning which offers curriculum support to 100s of schools

- Newton could offer the backend for Dreamtime leading and in return charge subscription revenue + ability to upsell ERP features

- Continue educational events with new ICP focus and goals

- Enterprise deals with large educational groups

- Premium schools with premium parents with premium needs

- Bespoke customisation expectaions

- Low CAC with low turn around times and limited decision makers

- whitelabelling to become feasible

Litmus Test if Newton is ready for partnerships:

Question | Answer |

|---|---|

1. Do you have product market fit? | Yes, it has, with 0 customer churn over the last few quarters and strong interest in the market with reduced decision making times are strong indicators |

2. Are you finding it difficult to acquire new customers or enter a new market? | Yes, we haven't yet found the perfect pitch that works for all demographics, but we believe with the group school approach we can break this barrier |

3. Are you looking to drive power users? | No, Focus is purely on overall adoption across all user types |

4. Do you have customers making requests for new features? | Yes, but we now have a stable product pipeline with requests flowing down the pipeline. |

Current Partners :

- Razorpay, Cashfree and Jodo : Payments and Fee financing apps that complement our Finance module and enable easy collections for our schools. We also gain payment commissions while these PGs can acquire large payment volumes at bulk

- Leadsquared : Lead management with Marketing Automation and CRM tools for Schools. With partnership with Leadsquared we currently can extend the feature of Newton in-app while allowing Leadsquared to offer a finance management platform to their school clients

- Neo Track : Transport tracking app for school buses. With Integration + partnership with newton we allow all data to be centralised on Newton removing the need for the school to use more apps. Neotrack can offer this seamless integration to their partner schools with revenue sharing / commission models left to be explored

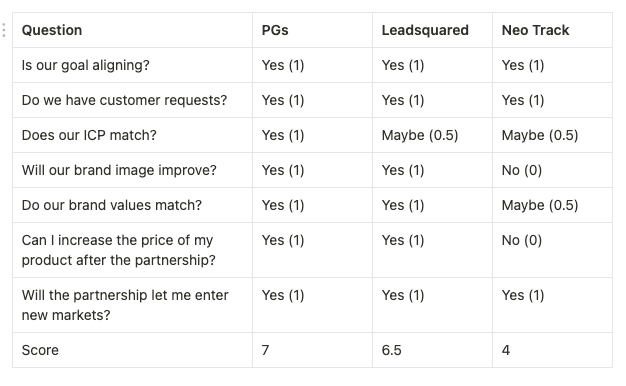

Partner Fitment Test:

Experiment 1 : Outbound Strategy Based on Podcasts

Objective:

Leverage weekly live podcasts with educators to establish Newton as a thought leader in education technology, build social currency, and create engagement with the target audience.

1. Strategy Overview:

- Podcast Format: Weekly live recordings featuring educators as guest speakers, focusing on the intersection of education and technology.

- Branding: Promote the podcast under the Newton brand, highlighting the innovative approach to education management.

- Partnerships: Collaborate with education event companies to secure high-quality participants and broaden reach.

2. 12-Week Content Plan

| Week | Topic | Guest Type | Key Focus Areas |

|---|---|---|---|

| 1 | The Future of Education: Embracing Technology | Educational Visionary | How technology is reshaping the classroom experience |

| 2 | Implementing School ERP Systems: Challenges and Opportunities | School Administrator | Best practices for implementing ERP systems in schools |

| 3 | Personalized Learning: The Role of AI in Education | EdTech Innovator | How AI is enabling personalized learning experiences |

| 4 | Enhancing Student Engagement with Digital Tools | Teacher/Facilitator | Effective digital tools for increasing student engagement |

| 5 | Data-Driven Decision Making in Schools | Education Data Analyst | The importance of data analytics in improving school operations |

| 6 | Building Digital Literacy: Preparing Students for the Future | Curriculum Developer | Strategies for integrating digital literacy into the curriculum |

| 7 | Cybersecurity in Schools: Protecting Student Data | IT Specialist | Addressing cybersecurity challenges in educational institutions |

| 8 | The Impact of Remote Learning: Lessons from the Pandemic | Principal | Insights from the shift to remote learning and its long-term effects |

| 9 | Collaborative Learning: Using Technology to Foster Teamwork | Educational Consultant | Tools and strategies for promoting collaborative learning |

| 10 | The Role of Technology in Special Education | Special Education Expert | How technology is supporting students with special needs |

| 11 | Parental Involvement in the Digital Age | Parent Liaison | Engaging parents through digital platforms and communication tools |

| 12 | The Future of Assessments: Moving Beyond Standardized Testing | Educational Researcher | Exploring alternative assessment methods powered by technology |

3. Podcast Production and Promotion Plan

- Recording: Set up a professional recording environment for high-quality audio and video. Schedule recordings weekly with flexibility for guests.

- Editing: Post-production should focus on enhancing audio quality, adding branding elements, and ensuring a polished final product.

- Distribution: Distribute the podcast on platforms like YouTube, Spotify, Apple Podcasts, and Google Podcasts. Publish a blog post for each episode summarizing key takeaways.

4. Engagement and Social Currency

- Social Media: Create engaging social media posts with highlights, quotes, and clips from each podcast episode. Use platforms like LinkedIn, Twitter, Instagram, and Facebook.

- Email Campaign: Develop an email newsletter to notify subscribers of upcoming episodes, provide recaps, and encourage feedback.

- Community Building: Encourage listeners to join a dedicated online community where they can discuss episodes, share insights, and connect with other educators.

5. Partnership and Participant Acquisition

- Event Partnerships: Partner with education event companies to promote the podcast at relevant conferences and seminars. Offer exclusive podcast content or live recordings at these events.

- Guest Outreach: Develop a systematic approach to reaching out to potential guests, including influential educators, administrators, and EdTech experts. Offer value by positioning them as thought leaders and providing them with professionally produced content they can share with their networks.

- Audience Growth: Use partnerships to grow the podcast's audience by offering co-branded promotions, guest appearances, and exclusive content to event participants.

6. Performance Tracking and Optimization

- Metrics to Track: Monitor podcast downloads, social media engagement, email open rates, and website traffic to evaluate the effectiveness of the campaign.

- Feedback Loop: Regularly gather feedback from listeners and guests to refine content, format, and promotional strategies.

- Quarterly Review: Assess the overall performance of the podcast strategy every three months to identify areas for improvement and plan the next content cycle

Currently exploring this on our company Youtube Page

www.youtube.com/@newtonclassroom

Referral Program/Partner Program

Since we are a B2B company referral is not considered ethical as discussed in the sessions. Partner program already explored above

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.